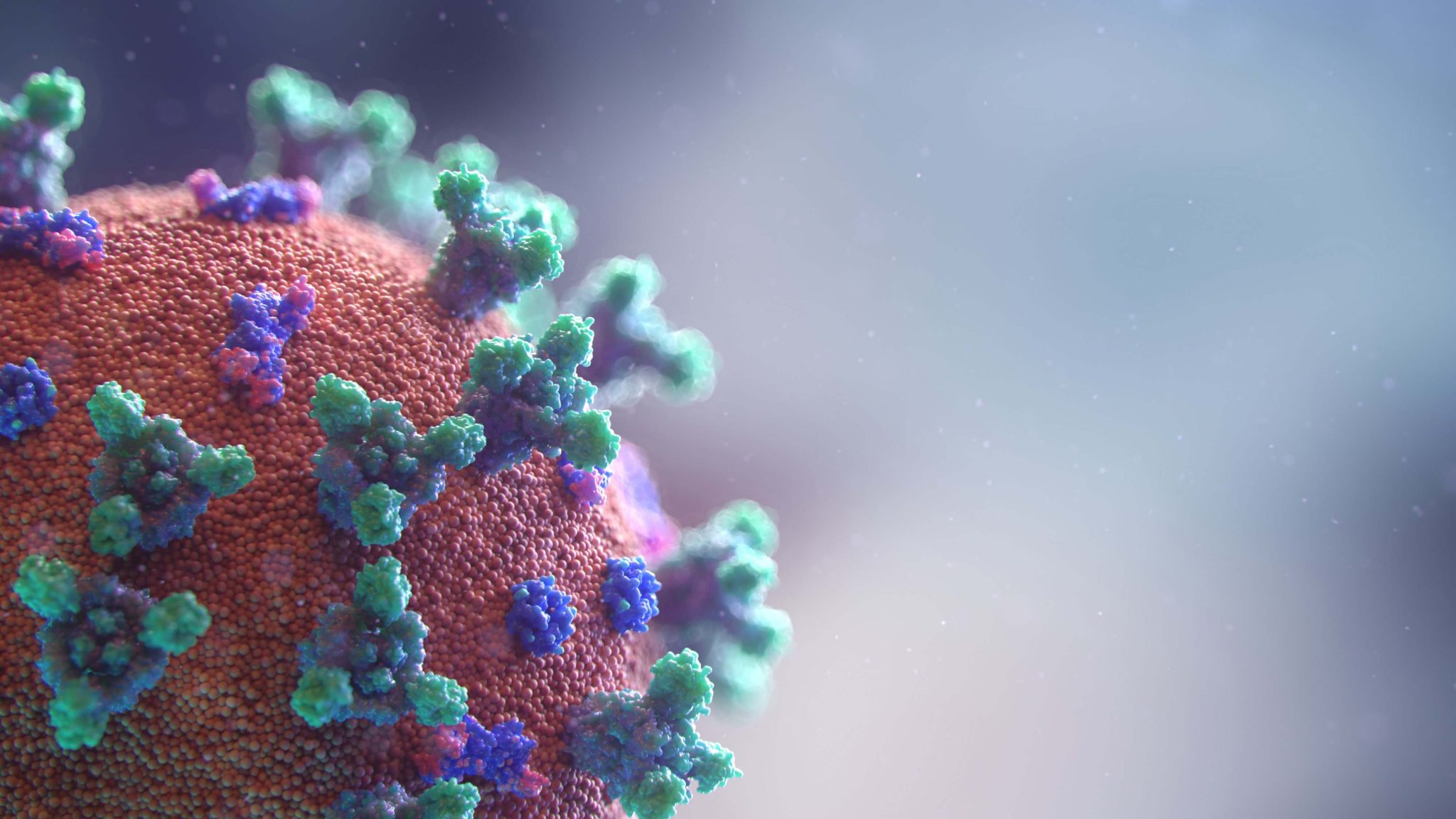

We are continuing to closely monitor recommendations from the Public Health Agency of Canada (PHAC) and the World Health Organization (WHO) and at this time, the PHAC has deemed the risk to the Canadian general public as low.

Below you will find information to help answer many of your questions on how the COVID-19 virus impacts your group benefits coverage.

Refilling prescription drugs

Within Canada – There is no change to our prescription drug coverage. Plan members will only be reimbursed for prescription drugs at their appropriate refill intervals.

Outside of Canada – If a plan member traveled to a region prior to a travel advisory being issued for that region and their return to Canada is delayed, they can submit their prescription drug receipts for consideration.

Out of Country coverage for locations with travel advisories

Plan members will have Out of Country (OOC) coverage if travel started before the advisory came into effect. However, if PHAC issued a Level 3 – Avoid non-essential travel or Level 4 – Avoid all travel advisory before plan members traveled, the claim may not be considered.

Travel by cruise ship

PHAC has issued an advisory to avoid all cruise ship travel. If plan members choose to travel after the advisory was issued, plan members may not be eligible for OOC coverage.

Trip interruption

Trip interruption or cancellation coverage is not included in our standard OOC coverage.

Quarantine due to travel prior to the advisory

Self-quarantine – Only quarantine directed by a physician or public health agency may be considered eligible for benefits.

Reimbursement for meals and accommodation – If the plan member was placed under quarantine by a physician or public health agency, and their policy includes our Travel Benefits Plus coverage, they would be eligible for reimbursement for meals and accommodation.

Insured Short-Term Disability (STD) plans – If the plan member was placed under quarantine by a physician or public health agency, is being tested for COVID-19 and is unable to work from home, they are eligible for short-term disability benefits. The waiting period will be waived. Plan members will be required to submit an Attending Physician Statement (APS), if possible. If unable to obtain an APS, a Confirmation of Illness form can be used. The Confirmation of Illness form is available from our Group Client Service Centre

Note: Administration Services Only (ASO) plan sponsors will need to confirm their agreement with the special handling of COVID-19 STD claims for their plan.

As the situation continues to evolve, our position may be impacted by government declarations and programming.

The health and safety of our plan members are very important to us!

Please review the latest travel health notices for information on affected locations.

We would like to reassure you that we have Business Continuity Plans in place and that services to our clients will not be interrupted. We are committed to maintaining the strong levels of service our clients are accustomed to.

Questions?

We will continue to monitor the developments and will provide updates as required. If you have any questions, please contact our Group Client Service Centre at 1-800-667-8164 Monday to Friday from 8:00 a.m. to 8:00 p.m. EST.